Our Strategy

CCREAT provides investors with long-term sustainable income and capital growth from a portfolio of industrial and commercial scale renewable energy generation and storage assets.

CCREAT builds, owns and operates assets that:

- Have contracted revenue streams, providing investors with improved certainty of long-term earnings

- Generate and store renewable energy

- Deploy leading edge, proven technology

CCREAT focuses primarily on behind-the-meter renewable energy projects co-located with Australian businesses, to provide long-term competitive electricity prices and support their ESG targets for operating in a low-carbon economy.

Growing, Sustainable Income

- Portfolio earnings are supported by long duration, inflation linked energy supply contracts

- Value to energy users is underpinned by the structural cost advantage of well designed, dedicated behind the meter energy supply vs alternative energy sources

- Energy generation assets are connected to the energy grid for ancillary revenue opportunities and benefit from green energy certification

Long-Term Capital Growth

- By originating and building projects directly and via a co-development partnership model, CCREAT is able to benefit from the value added by investing in the development of capital efficient, purpose built assets at a pre-construction cost

- Capital appreciation of >25% on construction cost is sustainably targeted from construction through to final commissioning

- CCREAT’s significant capital deployment runway is supported by the volume of investment required for industrial and commercial energy users to transition to sustainable energy solutions

Diversification

- CCREAT’s operating and development portfolio is diversified across energy regions, industries and counterparties

- Diversification across asset life, from pre-construction and early works, to fully commissioned and staged construction, provides balanced exposure to capital growth while reducing project delivery risk exposure

- Diversification across technologies and end-use, from traditional food processing and mining to hydrogen production, provides exposure to the green energy economy with reduced pathway, technology or policy and regulatory risk

Operating Portfolio

CCREAT’s portfolio of operating renewable energy assets provides a sustainable revenue foundation, supporting portfolio expansion and distributions to investors.

As at June 2024, CCREAT’s >$30m in assets (net of buybacks and distributions) was achieved from $23m in total capital investment.

CCREAT targets investment returns of 11-18% pa through a combination of construction and delivery of pipeline assets, site and project augmentation, and distributions from operating assets. Long term portfolio target returns are:

6-8% pa

Distribution yield target

5-10% pa

Capital growth target

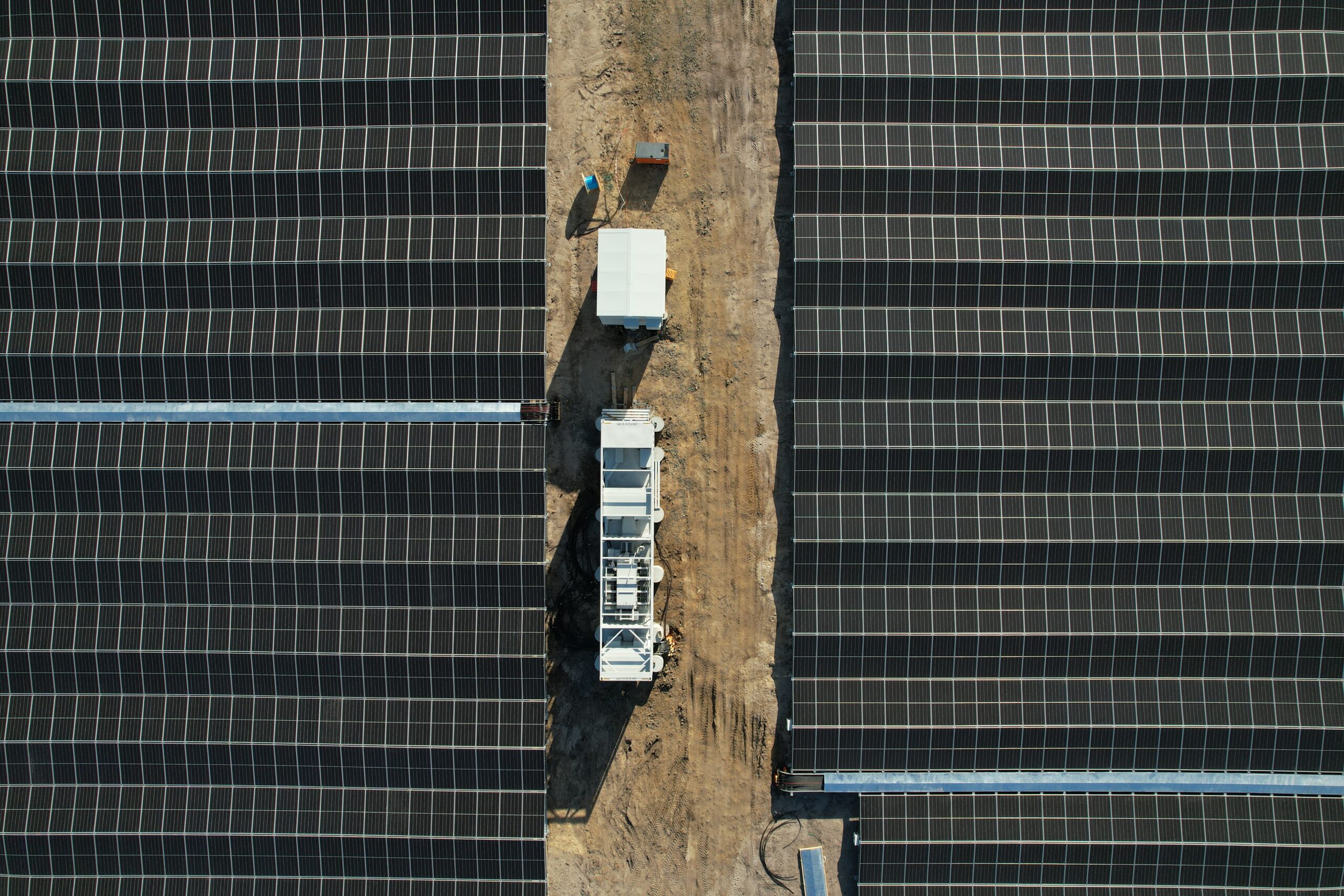

Bell Bay Solar Farm

>$7m

November 2023

4.95

Tasmania’s largest and first grid-connected solar farm. This solar farm is attractively placed adjacent to the Bell Bay Advanced Manufacturing Zone. BTM energy supply is earmarked for Line Hydrogen under a 25-year PPA, while secondary long-term revenue strategies are available.

Junee Solar Farm

>$3m

June 2023

2.32

A 2.32MW solar array located in Junee, NSW. This project has a 25-year BTM PPA with a large local agribusiness. Future stages of solar and potential battery are planned, with data analysis and studies currently underway.

Tregalana Solar Farm

>$6m

June 2023

4.95

Located in the highly solar energy productive region of Whyalla, SA. This project has a take-or-pay PPA with a BTM counterparty. This project was funded over two stages with energisation of Stage 1 occurring in June 2022 and Stage 2 in June 2023.

Boonanarring Solar Farm

>$5m

September 2020

2.50

Climate Capital’s inaugural project investment reached commissioning status in September 2020 having been achieved both on-schedule and to budget. Generation is currently exceeding expectations with offtaker processing facilities planned for the site.

Project Pipeline

By leveraging Climate Capital’s networks and expertise, CCREAT is able to deploy capital efficiently to develop environmentally sustainable, low-cost energy solutions for a diversified base of energy users in support of their financial and climate sustainability goals.

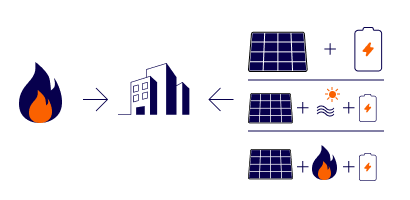

Micro-Grid

Projects involve renewable energy generation and storage systems built to integrate with existing operations and reduce or replace micro-grid reliance on diesel. Renewable micro-grids generate significant environmental and financial benefits for both generator and energy user.

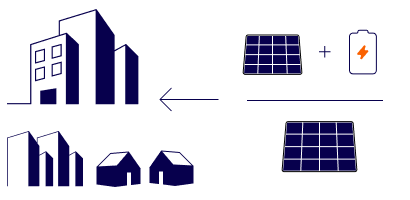

Embedded Network

An embedded network consists of dedicated renewable energy generation for one or more energy users. The system may involve multiple energy generation sources as well as users connected to one embedded network attached to the national energy network, or be orchestrated via a virtual power plant (‘VPP’) model.

Behind the Meter

Dedicated renewable energy generation located behind the meter and designed for optimal integration with co-located energy user (load) assets. Engineering and design are subject to both load and grid requirements, and targeted to deliver optimal financial and environmental outcomes.

Long-Term Pipeline

Portfolio Value ($) and Target Investment Returns (%)

Yield

Capital Value (in mil $)

Target Capital Growth (%)

Installed Capacity and Climate Impact

Total Tonnes CO2 Abated

Installed Capacity (MW)

Total Equivalent Tree Seedlings Planted

Our Team

Rob Rorrison

Chairman of the Board

Climate Capital develops renewable projects around Australia, which are behind-the-meter or grid connected for offtake with a corporate counterparty; 1 – 100MW in capacity; and offer sector and geographic diversification to CCREAT’s asset portfolio.

Climate Capital’s mandate is to deliver and enable renewable energy projects that provide environmental, social and financial benefits. We do this by working with a wide range of corporate energy users, energy consultants, project developers, vendors and other proponents.

Read more about Climate Capital.