In an exciting new chapter, Climate Capital has established the Climate Capital Renewable Energy Assets Trust (CCREAT). This strategic step is a key part of our mission to support the green energy transition in Australia, helping to create jobs and foster economic growth by enabling Australian businesses to adopt more environmentally and financially sustainable energy solutions and investments. As we celebrate CCREAT, we reflect on the growth of our business and what this change means for our stakeholders.

A New Vision for a Sustainable Future

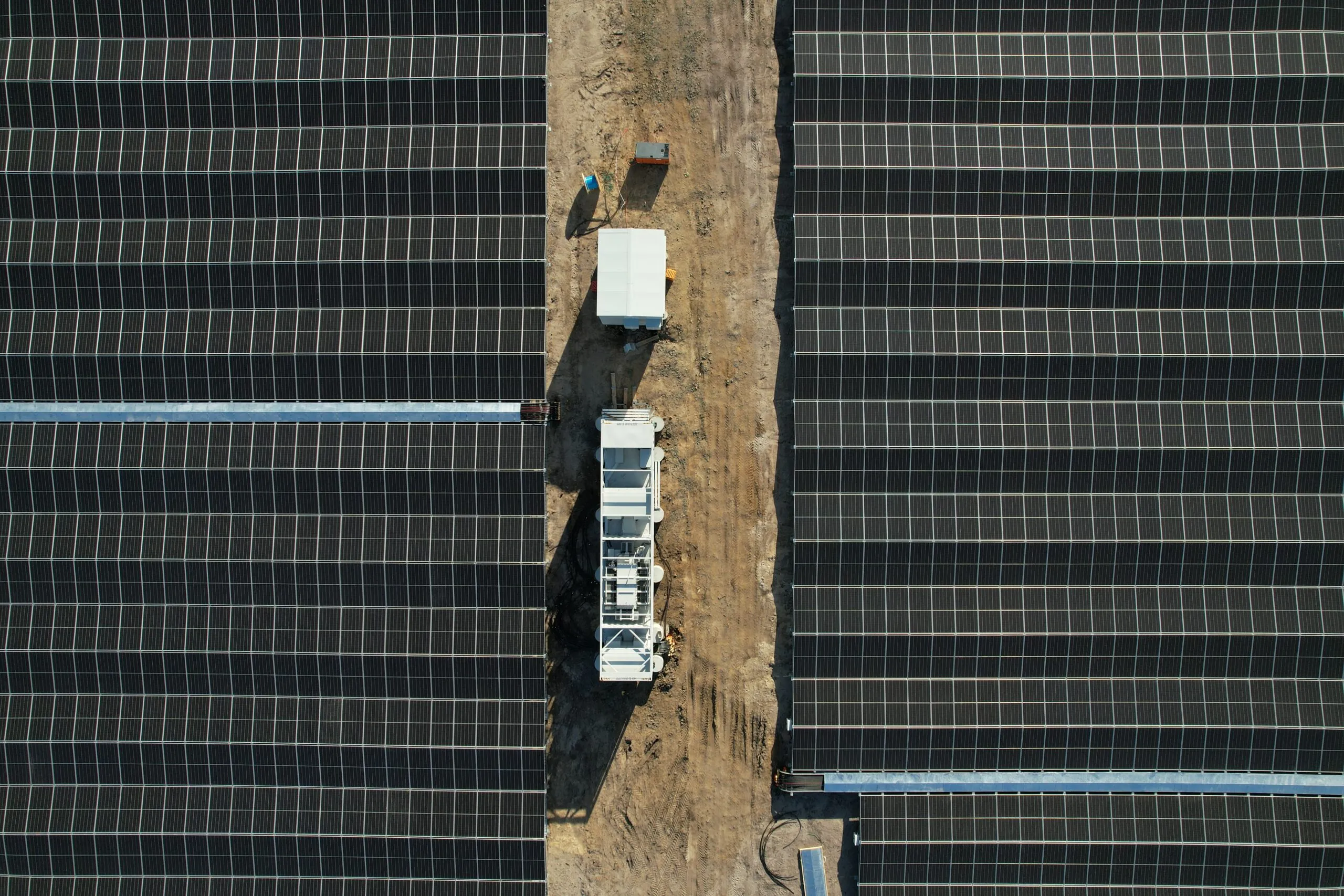

CCREAT’s mission is clear: to enable investors to directly participate in the renewable energy revolution by funding the construction and operation of renewable energy generation and storage assets. These assets are often co-located with or dedicated to specific Australian commercial and industrial businesses, ensuring a smoother, contracted revenue stream. This mission is about making a tangible impact on our planet while providing investors with reliable investments.

Expanding Horizons: A Focus on Sophisticated Investors

Climate Capital was founded with a strong focus on impact investing, and this approach continues to guide our efforts. Historically, our audience has included high-net-worth individuals and family offices known for their significant investments in startups. With the establishment of CCREAT, we are expanding our focus to attract a more sophisticated and professional investor base. This includes higher-end family offices, investment funds, and superannuation funds.

CCREAT’s appeal lies in its ability to enhance investors’ ESG (Environmental, Social, and Governance) credentials. By investing in CCREAT, funds can demonstrate their commitment to sustainable investing, meeting the growing demand for responsible investment options that align with environmental goals.

Active Management: A Hands-On Approach

One of CCREAT’s defining features is its active management of the fund. Unlike traditional investment firms, CCREAT takes a hands-on approach, which is reflected in our operational focus and direct engagement with projects. This approach ensures that we are deeply involved in the field, working closely with partners to make projects successful, from site scoping and community engagement to managing construction and operations.

For impact investors who prioritise environmental and social returns alongside financial ones, CCREAT’s model is particularly appealing. These investors understand that achieving significant ESG outcomes often requires a longer-term perspective and a willingness to engage directly with the challenges of the energy sector.

Celebrating Our Core Values

CCREAT’s core values remain steadfast: dynamic and professional, mission-focused, reliable, honest, and transparent. We focus on creating value through “win-win-win” opportunities—delivering good returns to our investors, providing cost savings and climate goal achievements for our energy offtaker counterparts, and replacing non-renewable energy with new, renewable energy generation. These values are the foundation upon which CCREAT is built, and they guide our commitment to providing long-term certainty and supporting our commercial partners in meeting their climate goals and reporting obligations.

A Unique Value Proposition

What sets CCREAT apart is its unique value proposition. We offer access to the legal, commercial, and financial infrastructure needed to fund projects at a sub-utility scale. Our ability to move quickly and apply on-the-ground partnerships ensures that projects are completed efficiently, without the delays associated with larger operations. This agility, combined with access to the right resources, positions CCREAT as a standout in the renewable energy investment space, offering investors exposure to both stable assets and new projects with significant upside potential.

Looking Ahead

As we embark on this new journey with CCREAT, we remain committed to offering investment opportunities that support the green energy transition, aligning with Australia’s broader mission to drive sustainable change. Our goals are to sustainably provide top-quartile returns to investors by deploying renewable energy technology, while supporting our energy offtaker counterparts in meeting their financial and sustainability goals. Investors can look forward to being part of a dynamic, impact-driven, and trustworthy investment partner that prioritises long-term gains for both the environment and their portfolios.

We invite you to join us in celebrating this exciting new chapter.